In a VAT dispute involving PT LSS, the Panel of Judges rejected the taxpayer's appeal. The main point of the dispute was a correction to a delivery for which VAT must be collected independently. This decision highlights the risks of not submitting data requested by the Directorate General of Taxes (DGT) during the audit process. This allows the DGT to use external data, even data from other tax sources, as a tool for determining revenue.

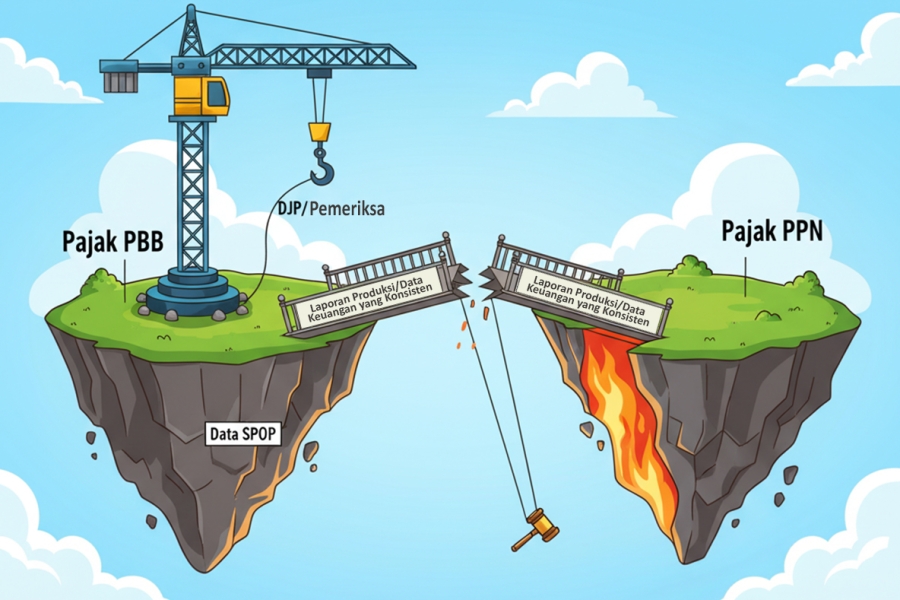

The main point of dispute in this dispute centers on the validity of the data sources used by the DGT. The DGT argued that because PT LSS was deemed uncooperative in submitting the requested Production Report, the auditor was forced to apply the Indirect Method. The DGT made the correction by using Plantation Productivity data reported by PT LSS in its 2016 Land and Building Tax (PBB) Tax Object Notification Letter (SPOP) as the standard for reasonable revenue. Reconciliation between potential production in the SPOP PBB and the actual VAT delivery reported by the taxpayer resulted in a difference that was corrected as additional business turnover.

The auditor's correction not only targeted the VAT DPP but also business turnover in CIT. Using the Indirect Method, fair turnover is established from the PBB SPOP data and reconciled with reported deliveries; the difference is determined as additional business turnover. Based on this, the VAT DPP is a direct derivative of turnover, and this adjustment automatically creates a VAT Object and VAT payable.

Conversely, PT LSS explained that the PBB SPOP not only reflects estimated production potential and does not correlate with actual sales and VAT payable. Furthermore, PT LSS emphasized that a decline in actual productivity in 2016 was also due to non-operational factors, namely a change in management that resulted in the loss of access to operational data.

Before reaching a decision, it should be noted that throughout the process, PT LSS failed to submit adequate material objections to the calculation of the correction to business turnover under Article 4 paragraph 2 of Final Income Tax, amounting to 1% of gross income in accordance with Government Regulation 46 of 2013 (MSMEs), which is then used as the basis for determining VAT. In fact, for eleven SKPKBs under Article 4 paragraph (2) of Final Income Tax arising from the correction to business turnover, PT LSS chose to settle them in full without further legal action.

In its legal reasoning, the Panel of Judges rejected PT LSS's appeal. The Panel concluded that the argument of difficulty obtaining data due to management changes was a normative objection and was not supported by concrete evidence at trial. Furthermore, PT LSS had agreed to and settled 11 Final Income Tax Underpayment Assessment Letters (SKPKB) under Article 4 paragraph (2) with a 1% business turnover correction in accordance with Government Regulation 46 of 2013, which served as the basis for the VAT DPP correction. For the Panel, this settlement substantially constituted an implicit acknowledgement and agreement to the DGT's corrected turnover. Therefore, PT LSS lacked sufficient grounds to challenge the VAT DPP correction, which was a direct derivative of the PPh business turnover correction.

This ruling sets an important precedent validating the use of SPOP PBB—data presented by taxpayers themselves for regional tax/PBB purposes—as a tool for auditors to make corrections.

The key lesson is that taxpayers must ensure data consistency across tax types and prioritize the provision of primary documents, such as production reports, to avoid the use of indirect methods that the Directorate General of Taxes (DGT) can use. Failure to maintain a consistent legal position between Income Tax and VAT disputes proved to be a decisive factor in taxpayer losses.

This case serves as a stark reminder for companies to ensure their operational and financial documentation systems are well-integrated and always ready for audits. The absence of even a single key document can lead to the use of non-standard methods by the auditor and, ultimately, the rejection of the appeal by the Tax Court.

A comprehensive analysis and the Tax Court's decision on this dispute are available here.